what is a quarterly tax provision

However if your net earnings equate to less than 5000 you may be able to file a Schedule C-EZ instead. Quarterly Hot Topics is now available.

Fin 48 Compliance Disclosing Tax Positions In An Age Of Uncertainty

If income tax rate is 30 calculate the profit before tax and provision for taxation for this year.

. Typically this is represented quarterly with each earnings. Annual ETR applied to YTD income plus discreet tax items make up the quarterly annual tax expense. The provision can be calculated on a monthly quarterly or annual basis as required.

Understand tax law changes impacting the provision. A tax rate is generated at the beginning of the year for summary periods such as Quarterly or Yearly. 16343 Interim provisionincome from equity method investments.

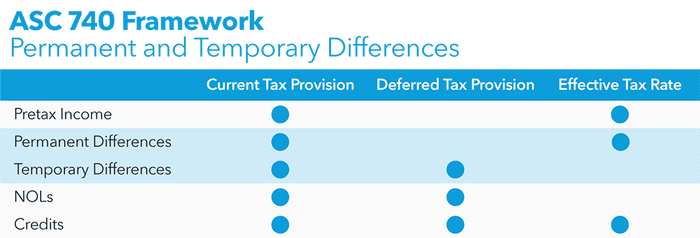

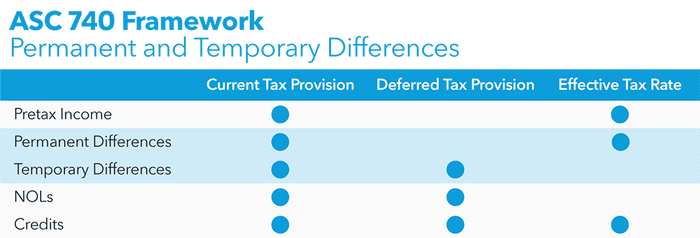

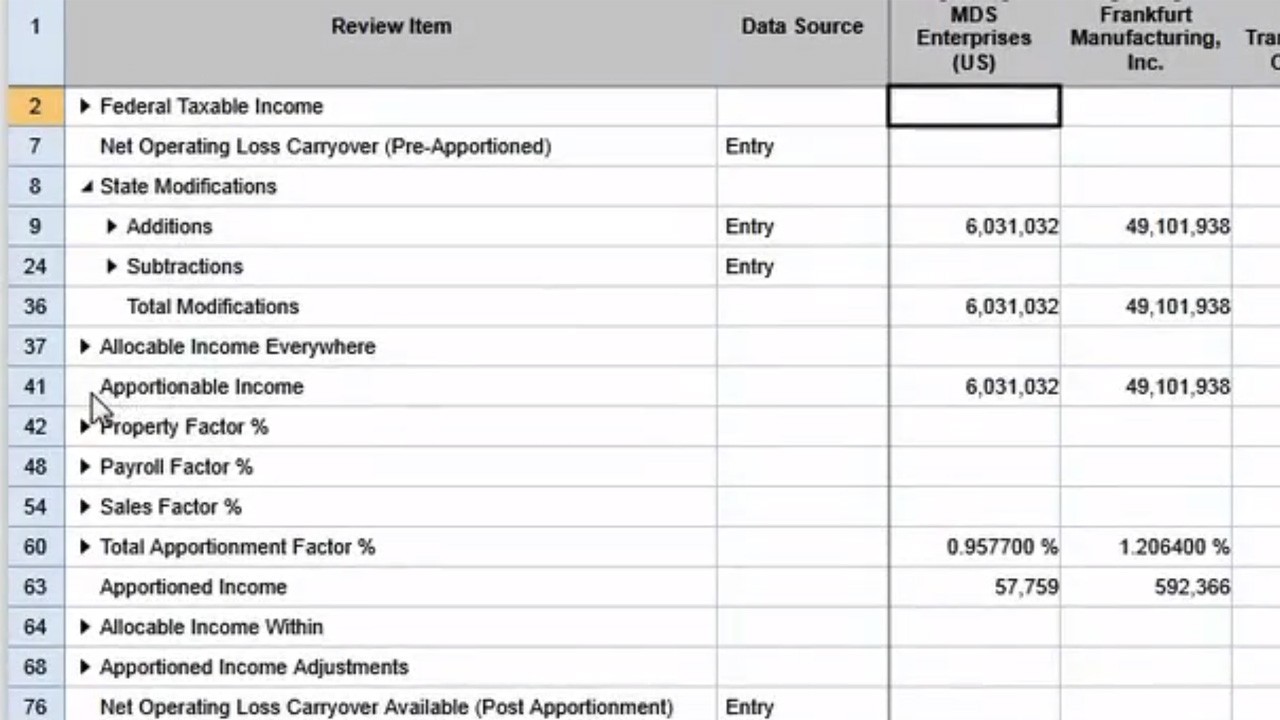

That rate is applied to year-to-date ordinary income or loss in order to compute the year-to-date income tax provision. The corporate income tax provision is an important and complex component of the financial statements and related disclosures and it is receiving ever-increasing scrutiny due to its significance to the operating statement. Minimizing your income tax bill is an important part of your financial plan.

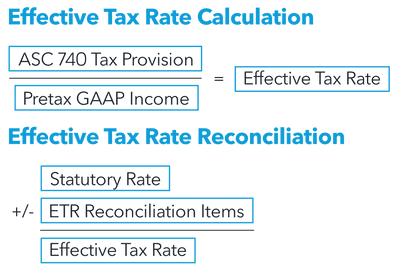

The most powerful ASC 740 calculation engine on the market our software solves the technical and process issues involved in calculating your income tax provision taking manual risks out of the equation. The ETR method uses the weighted average annual ETR and applies this. With quarterly provision filing deadlines approaching learn how to best organize your data to ensure ease and accuracy and opportunities to use software to simplify the process.

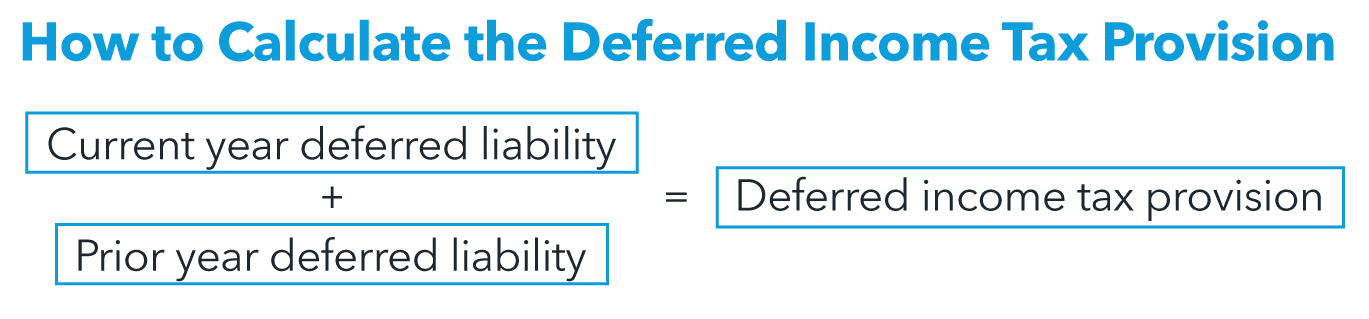

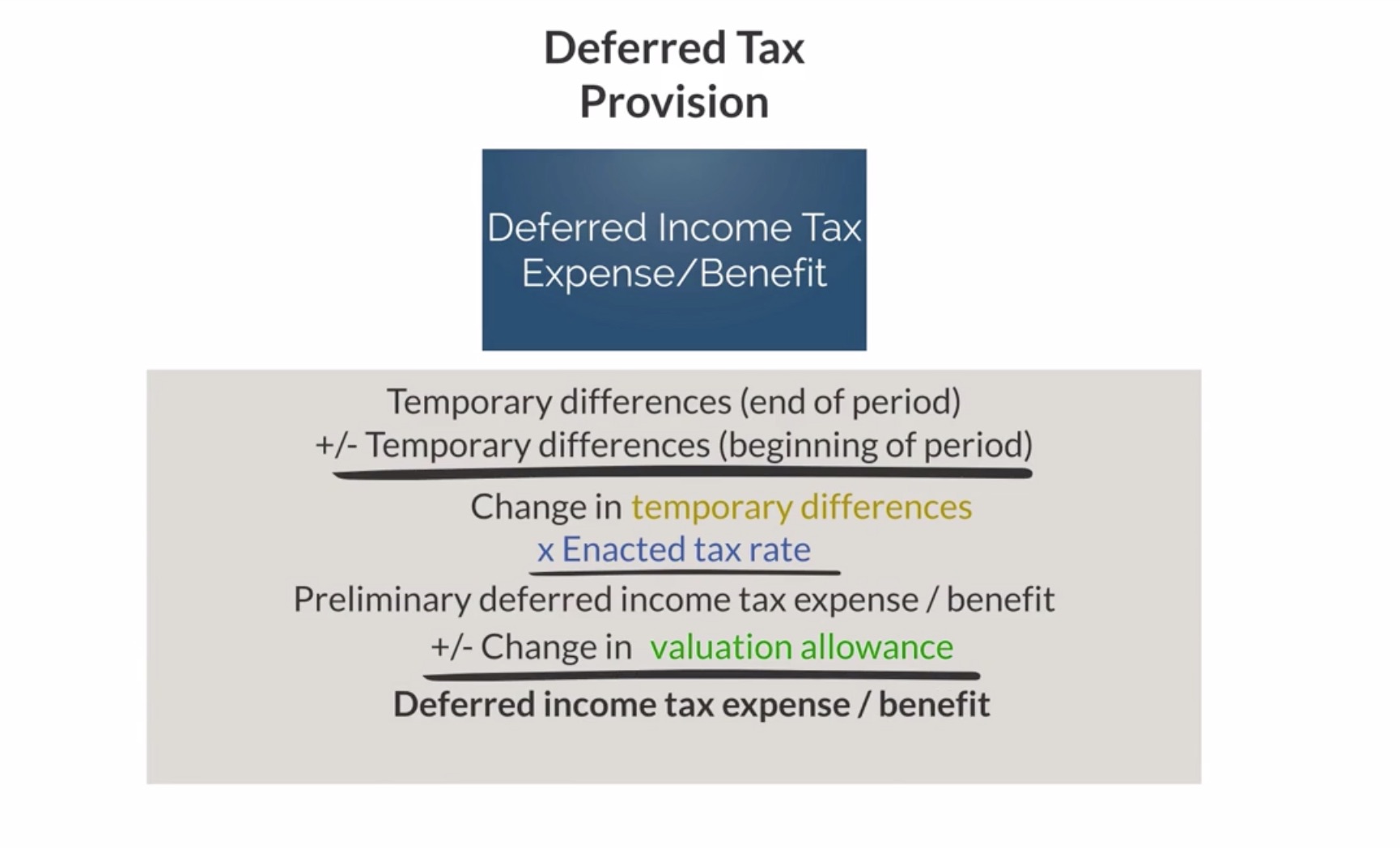

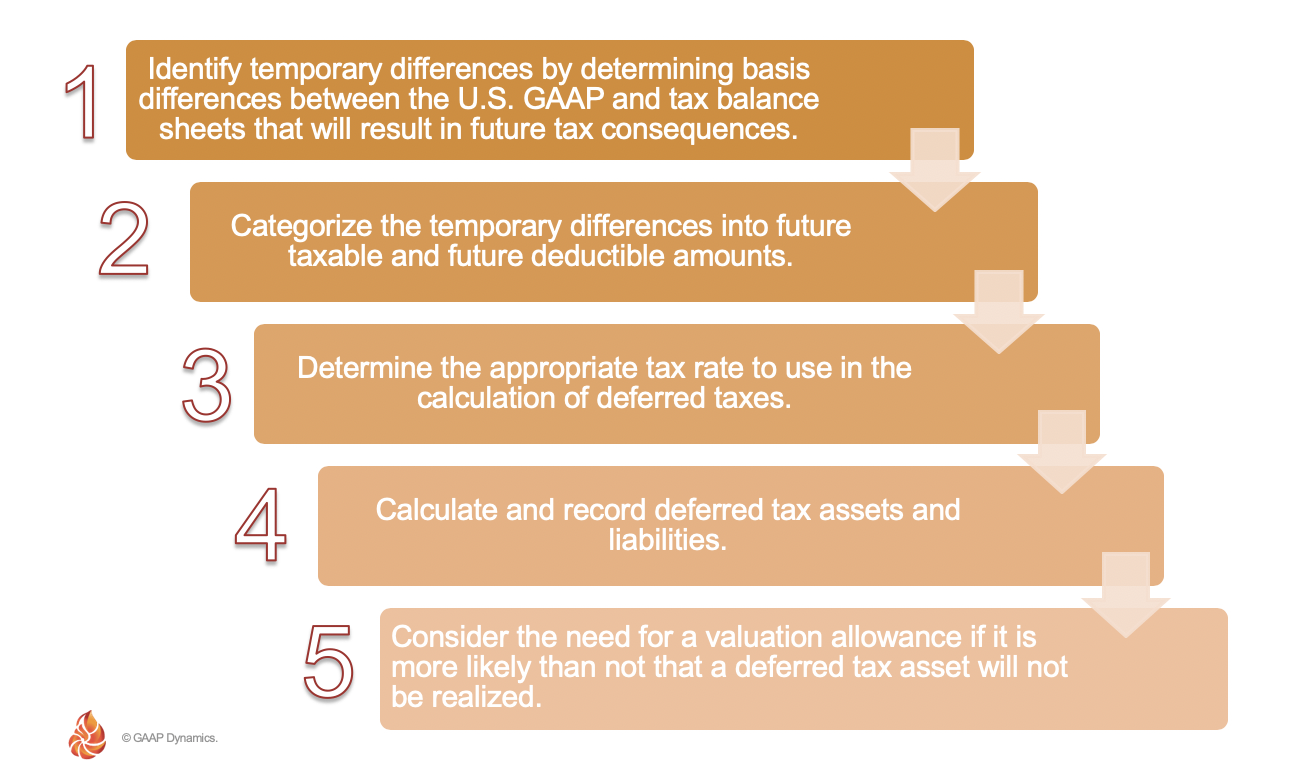

Recent editions appear below. The deferred tax calculation which focuses on the effects of temporary differences and other tax attributes over. Treating an item as discrete concentrates the tax effect in the quarter recognized while treating the item in the forecast annual ETR smoothes the tax impact over the full year.

In the income statement it will be reported as following. Tax distributions shall be made not less often than quarterly to each member at the times other than at the time of a terminating capital event necessary. In recent years tax-related issues have been a primary reason for restating financial statements and accounting for.

As provision for tax is an estimate of probable cash outflow the actual tax payment can be different. You do quarterly reviews less substantial in scope than an audit. A tax provision is comprised of two parts.

A provision for income taxes is the estimated amount that a business or individual taxpayer expects to pay in income taxes for the current year. Estimate Your Quarterly Taxes With TurboTax Self-Employed With Ease And Confidence. Us Income taxes guide 162.

Tax rate changes in the quarter in which the law is effective. The amount of this provision is derived by adjusting the firms reported net income with a variety of permanent differences and temporary differences. How to Pay Quarterly Taxes.

Calculate the quarter effective tax rate Q1 Q2 Q3 Q4 Projected full-year AETR 40 35 37 35 Quarterly book income 400 100 200 700 YTD book income 400 500 300 1000. The adjusted net income figure is then multiplied by the applicable. Based on the profit before tax calculated above the tax provision amount will be 12000 40000 x 03 Journal entry will be following.

Income tax provisions determined under the general recognition and measurement requirements for accounting for income taxes as per ASC 740-10 The estimated ETR includes the anticipated effect of income tax credits and. Save time and ensure accuracy with this powerful tax provision software. A companys current tax expense is based upon current earnings and the current years permanent and temporary differences.

The latest issue of Accounting for Income Taxes. Yes Im studying AUD right now the company estimates their taxable income for the year and every quarter you adjust the provision to correct what was. Ad File Quarterly Self-Employed Tax Forms With Ease And Confidence.

The provision is the audit part of tax. At each interim period a company is required to estimate its forecasted full-year effective tax rate. An Administrator or Power User can also create interim tax periods for example monthly or non-year end to estimate the current and deferred taxes for the interim period based on the Annualized Estimated Effective Tax Rate AEETR.

A tax provision is just one type of provision that corporate finance departments set aside to cover a probable future expense. IAS 3430a requires the use of the so called effective tax rate ETR method as the most appropriate depiction of a reporting issuers tax provision on a quarterly basis. The provision can be calculated on a monthly quarterly or annual basis as required.

Following is the calculation for profit before tax. It is typically appropriate to record an investors equity in the net income of a 50 or-less owned investee on an after-tax basis ie the investee would provide taxes in its financial statements based on its own estimated annual ETR calculation. Simply put a tax provision is the estimated amount of income tax that a company is legally expected to pay to the IRS for the current year.

Calculate the quarterly tax provision c. Other types of provisions a business typically accounts for include bad debts depreciation product. Current income tax expense and deferred income tax expense.

After calculation the system automatically translates the tax data from the local currency to the reporting currency for the consolidated reports. 162 Basic method of computing an interim tax provision. This issue discusses several important developments and related ASC.

Subscribe to receive Accounting for Income Taxes. The provision for income taxes on an income statement is the amount of income taxes a company estimates it will pay in a given year. Learn from other tax departments how theyre executing the provision efficiently and.

Even worse many doctors dont realize the difference between the amount of taxes that are withheld. The provision is always calculated on a year-to-date basis no matter how frequently it is calculated. Both forms will help you determine your net earnings or loss.

So if you discover youre required to pay quarterly taxes you must first use Schedule C of Form 1040 to determine how much you owe. Example 1 No Discrete Items Calculate the quarterly tax provision and the ETR for the quarter. Quarterly Hot Topics directly via email.

Many physicians either coming out of residency or moving from an employed position to one as an independent contractor or partner arent aware of the need to pay quarterly estimated taxes.

Accounting For Income Taxes Under Asc 740 An Overview Gaap Dynamics

How To Calculate The Asc 740 Tax Provision Bloomberg Tax

Know Your Taxes The 8 Income Tax Rate

Provision For Income Tax Definition Formula Calculation Examples

Bloomberg Tax Bloombergtax Twitter

Tax Manager Resume Samples Qwikresume

How To Calculate The Asc 740 Tax Provision Bloomberg Tax

Tax Compliance And Reporting Deloitte Tax Services

Estimated Tax Payments Software By Thomson Reuters Onesource

Fin 48 Compliance Disclosing Tax Positions In An Age Of Uncertainty

Accounting For Income Taxes Under Asc 740 An Overview Gaap Dynamics

Provision For Income Tax Definition Formula Calculation Examples

Accounting For Income Taxes Under Asc 740 An Overview Gaap Dynamics

Accounting For Income Taxes Under Asc 740 Deferred Taxes Gaap Dynamics

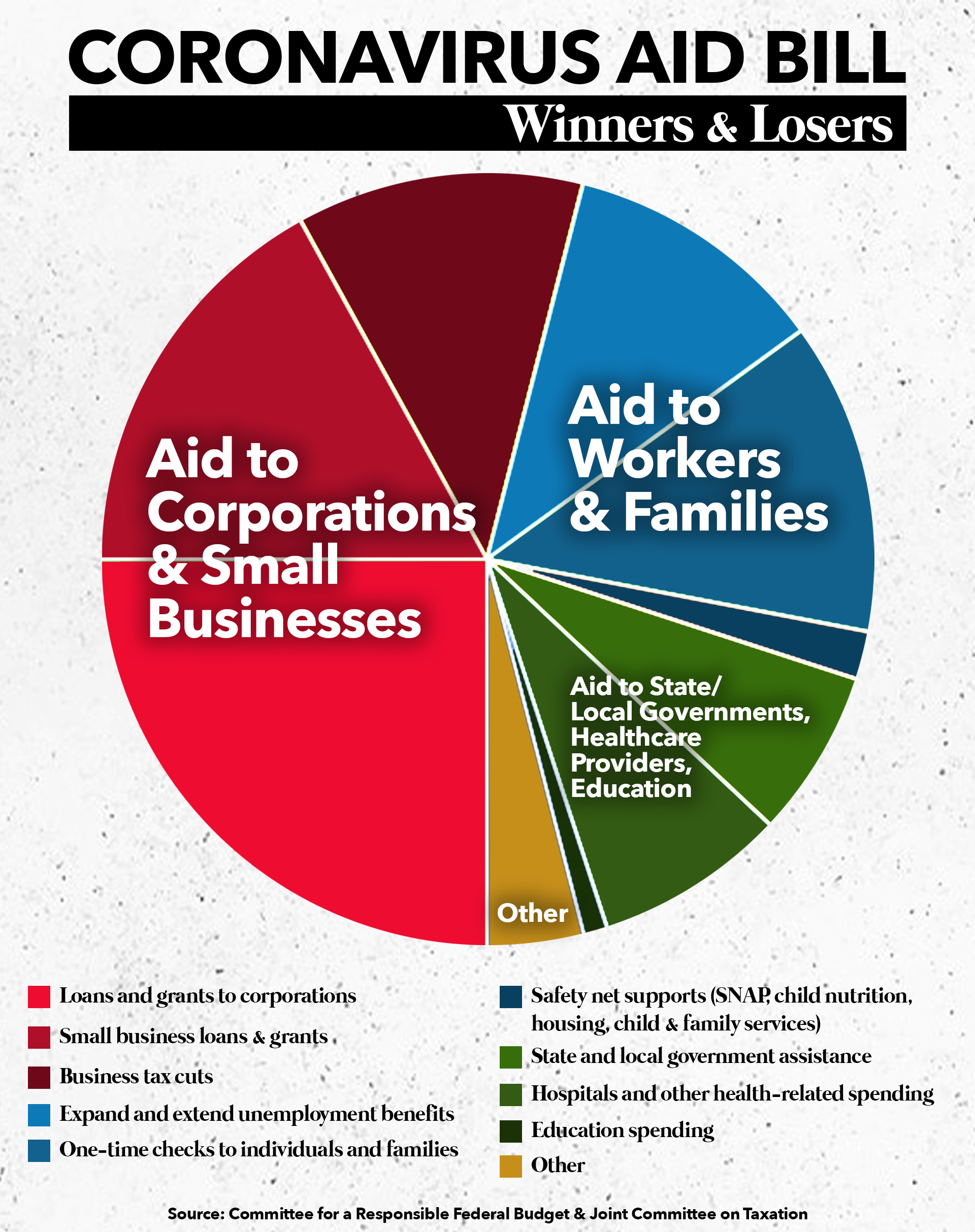

Summary Of Major Tax Provisions In The Senate And House Coronavirus Stimulus Bills Americans For Tax Fairness