arizona charitable tax credits 2020

Websites providing accurate and useful information regarding Arizona Qualifying Charitable Organizations 2020 are shown on the results list here. That means you can still donate and get the credit if you havent already.

Ava Members Save Big On Everything At Ava Academy Earn Ces From Webinars Previous Scientific Meeting Sessions Proced Vascular Central Venous Catheter Access

For the Arizona Credit for Contributions to Charitable Organizations Form 321 only Cash Donations qualify.

. The maximum PLUS Switcher credit amount that may be taken for tax year 2020 is 1179 for married filing joint and 590 for all other taxpayers. You can choose any of the tax credit eligible organizations and donate between now and either December 31 2021 or. The Arizona Charitable Tax Credit is what is referred to as a nonrefundable income tax credit.

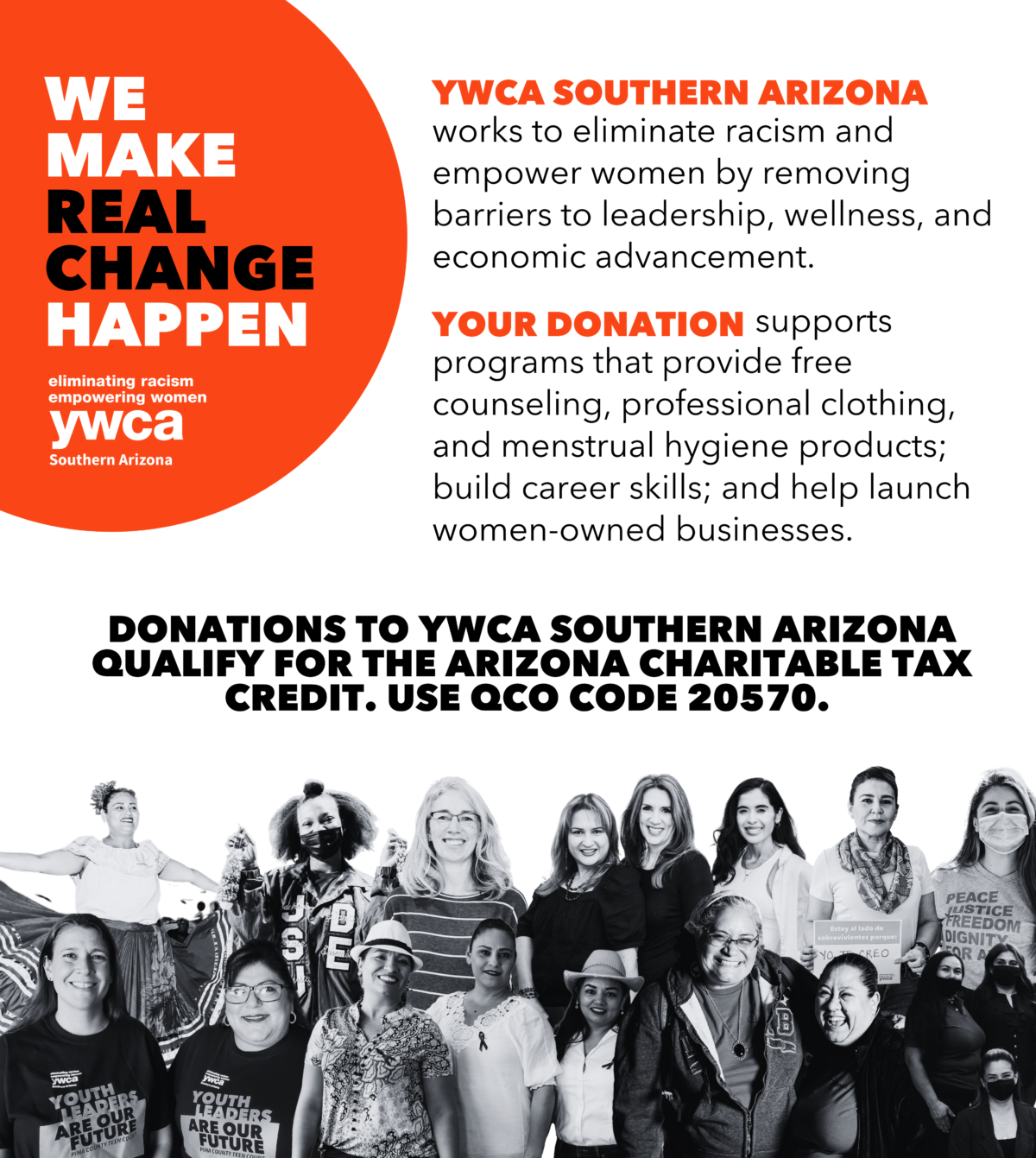

Arizona Charitable Tax Credit You can provide free healthcare for those in need at no cost to you. Take a credit on your Arizona State tax return Up to 400 for individuals and 800 for couples. These tax credits reduce your Arizona income tax liability dollar for dollar.

The maximum contribution allowed is 800 for married filing joint filers and 400 for single heads of household. Arizona Charitable Tax Credit Guide 2020 Published by St. Arizona provides two separate tax credits for individuals who make contributions to charitable organizations.

Marys Food Bank this year. If you donate after. With the Arizona Charitable Tax Credit you can donate up to 800 to St.

And the second for donations to Qualifying Foster Care Charitable Organizations QFCO. 5025 E Washington Street Suite 212 Phoenix AZ 85034 602 773-5773 20842. The Arizona Department of Revenue ADOR advises taxpayers they have until May 17 to make donations to qualifying charitable organizations to claim the tax credits on their 2020 individual income tax return.

ARIZONA CHARITABLE DONATIONS TAX CREDITS AZ Revised Statute 43-1042 Charitable donations which qualify for an AZ Tax Credit have special treatment on the Federal Tax Return if the Taxpayer ITEMIZES see B. 2435 Married filing jointly 1219 filing Single LEARN MORE Qualified Charitable Organization. ARIZONA CHARITABLE TAX CREDITBig Brothers Big Sisters of Southern Arizona SOAZBIGS is a Qualified Charitable Organization QCO code 20461 for the Arizona.

Donations to the Arizona Military Family Relief Fund must be paid before the annual cap of 1 million is reached which was Dec. Just make sure to your contribution to RMHCCNAZ up until April 15 2021 to be eligible on your 2020 tax filings. Help us feed the hungry in Arizona donate the maximum amount to St.

Say Thanks by clicking the thumb icon in a post. The Arizona Charitable Tax Credit permits any credits for contributions to Qualified Charitable Organizations QCOs and Qualifying Foster Care Charitable Organizations QFCOs that are not applied against tax obligations for the most recent taxable year to be carried forward for a period of five consecutive years. Arizonas 2020 Charitable Tax Credits Jennifer Ward Arizonas tax credits allow taxpayers to redirect their tax dollars for charitable giving.

When you make a donation to St. If the taxpayer uses the Standard Deduction see A then no adjustment is needed. Scholarship enrollment Scholarship details will be also included.

Through the Arizona Charitable Tax Credit you can receive a credit on your Arizona tax liability up to 400 individually or 800 for couples filing jointly. This tax credit is a two-fold deal with credits available for both Qualifying Charitable Organizations QCOs and Qualifying Foster Care Charitable Organizations QFCOs. Marys Food Bank you can receive a dollar-for-dollar tax credit on your AZ state return up to 400 for individuals and 800 for those filing jointly.

Summary of 2020 Private School Tuition Organization Credit Maximums. Marys Food Bank and get all of it back in your Arizona tax refund. Mark the post that answers your question by clicking on Mark as Best Answer.

Donations made between January 1 2021 and April 15 2021 can be claimed as a credit on either your 2020 or 2021 state tax return. Name of Organization Address QCO Code Qualifying organizations for cash donations made between January 1 2020 and December 31 2020 20493 Benevilla 16752 N Greasewood St Surprise AZ 85378 20598 Benson Area Food Bank 370 S Huachuca Street Benson AZ 85602 20332 Big Brothers Big Sisters of Central Arizona 4745 N Central Ave Suite 210 Phoenix AZ. For all of them you have until April 15 2021 or until the date you file your return if you do so early to donate for the 2020 tax year.

The Arizona Tax Credit program is beneficial for state taxpayers because it allows some control over where tax dollars are going. Name of Organization Address Phone QCO Code Qualifying organizations for cash donations made between January 1 2020 and December 31 2020 20841 Arizona Assistance in Healthcare AZAIH PO Box 5157 Goodyear AZ 85338 623 207-3377 20353 Arizona Autism United Inc. View solution in original post.

You may claim an AZ tax credit for making contributions to a School Tuition Organization to create scholarships for kids in private school. Marys on December 10 2020 Categories Tags What is the Arizona Charitable Tax Credit. There are four major tax credits that you can use to offset certain charitable donations in Arizona.

The maximum credit allowed is 1000 for married filing joint filers and 500 for single heads of household and married filing separate filers. Qualifying Charitable Organizations and. Click the link for detailed info at the Arizona Dept.

The 2022 Definitive Guide To The Arizona Charitable Tax Credit Phoenix Childrens Hospital Foundation

Breakdown Of 2020 Az Tax Credits Sterling Accounting Tax Llc

The 2022 Definitive Guide To The Arizona Charitable Tax Credit Phoenix Childrens Hospital Foundation

Qualified Charitable Organizations Az Tax Credit Funds

Donate To Arizona Tax Credit To Help Children Receive

Az Tax Credit Funds 2020 2021 Tax Credit Guidebook By Frontdoors Media Issuu

Tax Credit Central Arizona Shelter Services

Arizona Charitable Tax Credit For Southern Arizona Home Facebook

Arizona Charity Donation Tax Credit Guide Give Local Keep Local

Whiteboard Animation Character Whiteboard Animation Animated Characters Whiteboard Video Animation

Taxpayers Have Until May 17 To Donate To Charities Stos And Public Schools For 2020 Tax Year Smis

The 2022 Definitive Guide To The Arizona Charitable Tax Credit Phoenix Childrens Hospital Foundation

2020 Arizona Charitable And Public Charter School Tax Credits Tudor Financial Group Llc

Arizona Tax Credits Mesa United Way

Celebrating Breastfeeding Month Noah Health Center Breastfeeding Emotional Wellness Health Education

Charitable Contributions Count In Arizona Tempe Community Council