crypto tax calculator nz

You need to use amounts in New Zealand dollars NZD when filing your income tax return. Download your tax documents.

Koinly Crypto Tax Calculator For Australia Nz

Receiving mining or staking rewards.

. Eligible for a 4-year temporary tax exemption. An unrealised profit is when the market value of a token is higher than the original. You simply import all your transaction history and export your report.

The form then helps you calculate if you have paid too much tax or not enough. Get Started For Free. This is the amount you are liable for on your long-term gains tax.

The platform offers you ten clients and up to 100000 transactions per client. Google searches for cryptocurrency mining NZ are reaching record highs as Bitcoin and Ethereum hit 80000 NZD and 3000 NZD per coin generating a new influx of Kiwis interested in making money in one of the worlds fastest-growing industries. Receiving a payment in cryptoassets.

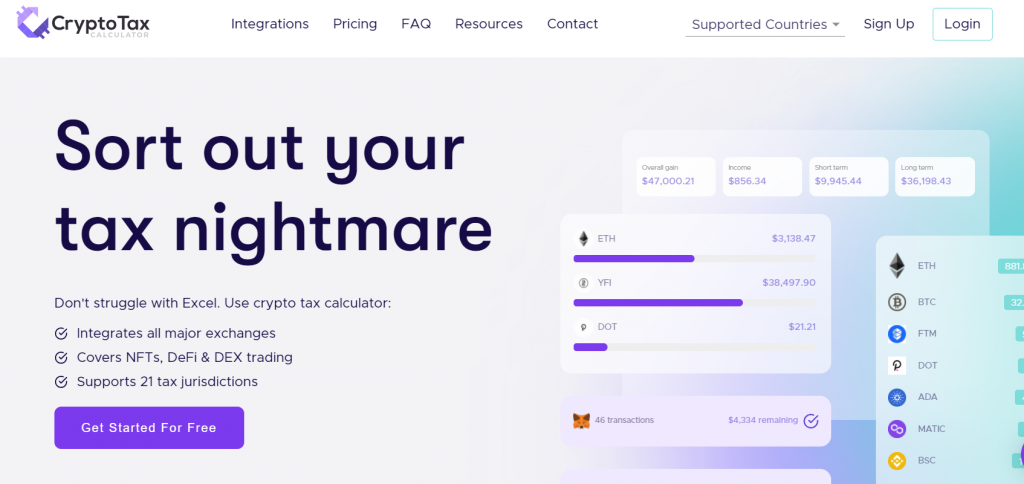

Over 500 integrations with support for complex scenarios such as DeFi NFTs. To help you on your mining journey weve created the following guide to lay out the key. Crypto taxes can be painful but with Crypto Tax Calculator a simple and easy-to-use tool you can prepare your taxes in a matter of minutes.

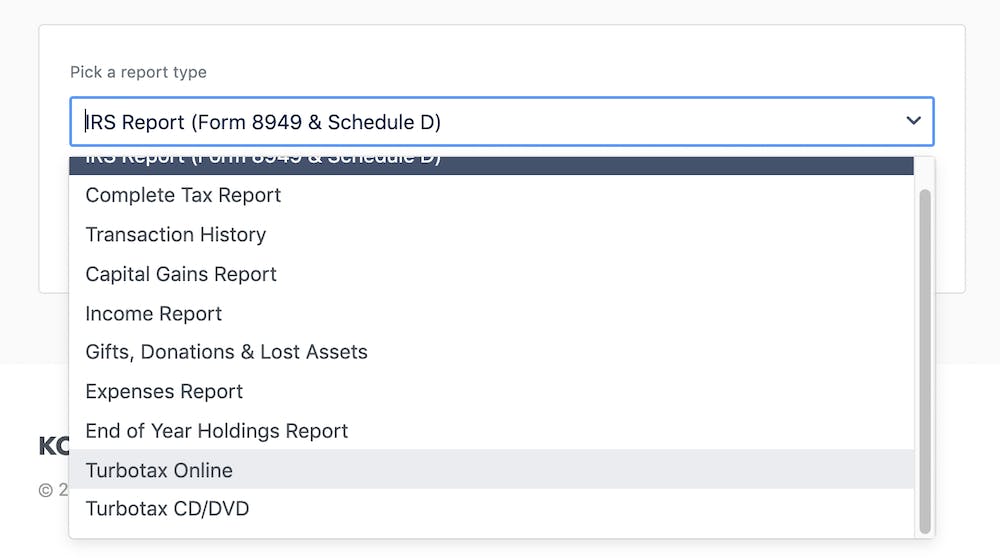

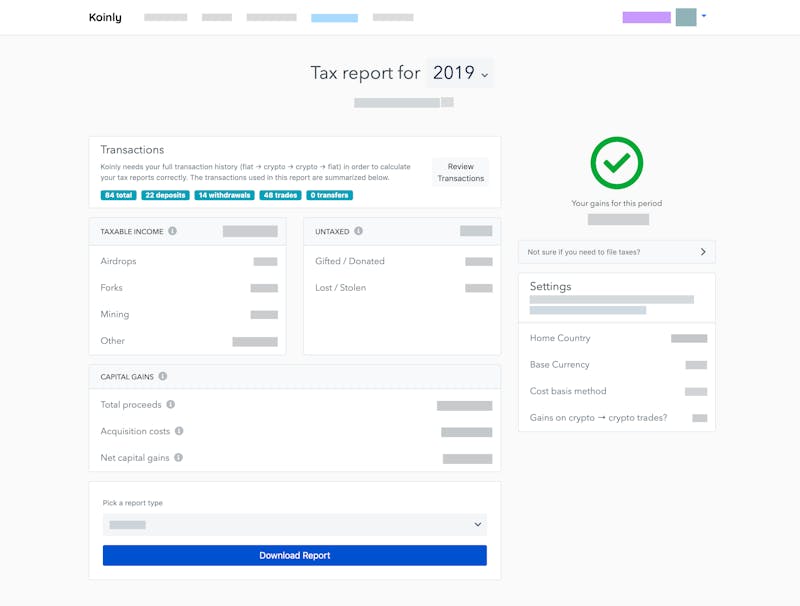

To claim a loss you need to show that if youd made a profit it would have been taxable. Taxed on worldwide income including cryptoasset income from overseas. Generate ready-to-file tax forms including tax reports for Forks Mining Staking.

CryptoTraderTax will automatically establish cost basis and fair market value for these transactions using historical data. The amount of tax you need to pay depends on how much income you have. We provide tailored and proactive cryptocurrency tax advice to all clients anywhere throughout New Zealand.

From 1 up to 14000. In this you include all of the income you have made in the year from all sources including wages dividends cryptocurrencies etc and all of the tax you paid. Founded by the mighty Craig MacGregor co-founder of Navcoin and a legend in the NZ Crypto scene Taxoshi is a homegrown tax calculation service that makes it easy for you to meet your NZ Crypto tax obligations.

Whether you are filing yourself using a tax software like TurboTax or working with an accountant. B If you are new or returning tax resident after 10 years. At ETHs current price as of 23022022 thats roughly a 125000 stake.

About Crypto Tax Calculator. Start by importing your crypto trading history from all years and from all exchanges into the app. Coinpanda generates ready-to-file.

When you complete your tax return if your cryptoasset income does not fit into any boxes such as business or self-employed income you need to put your net cryptoasset income or loss in the other income box. Crypto CPAs in New Zealand. The new Tax Calculator is a software as a service SaaS application that can simplify the process for US tax filings for individuals who hold crypto and need to report it on their US tax returns.

For the purpose of estimating Janes CGT tax on her crypto asset alone we then apply this 325 tax rate to the 5000 capital gain included in Janes assessable income. This is the amount you are liable for on your short-term gains tax. The tax residency status of an individual affects how tax is paid in New Zealand on the cryptoasset income.

Best Hardware Wallets in 2021. It is worth noting that The Crypto Tax Calculator offers a free-trial period 30 days as well. Completing your tax return.

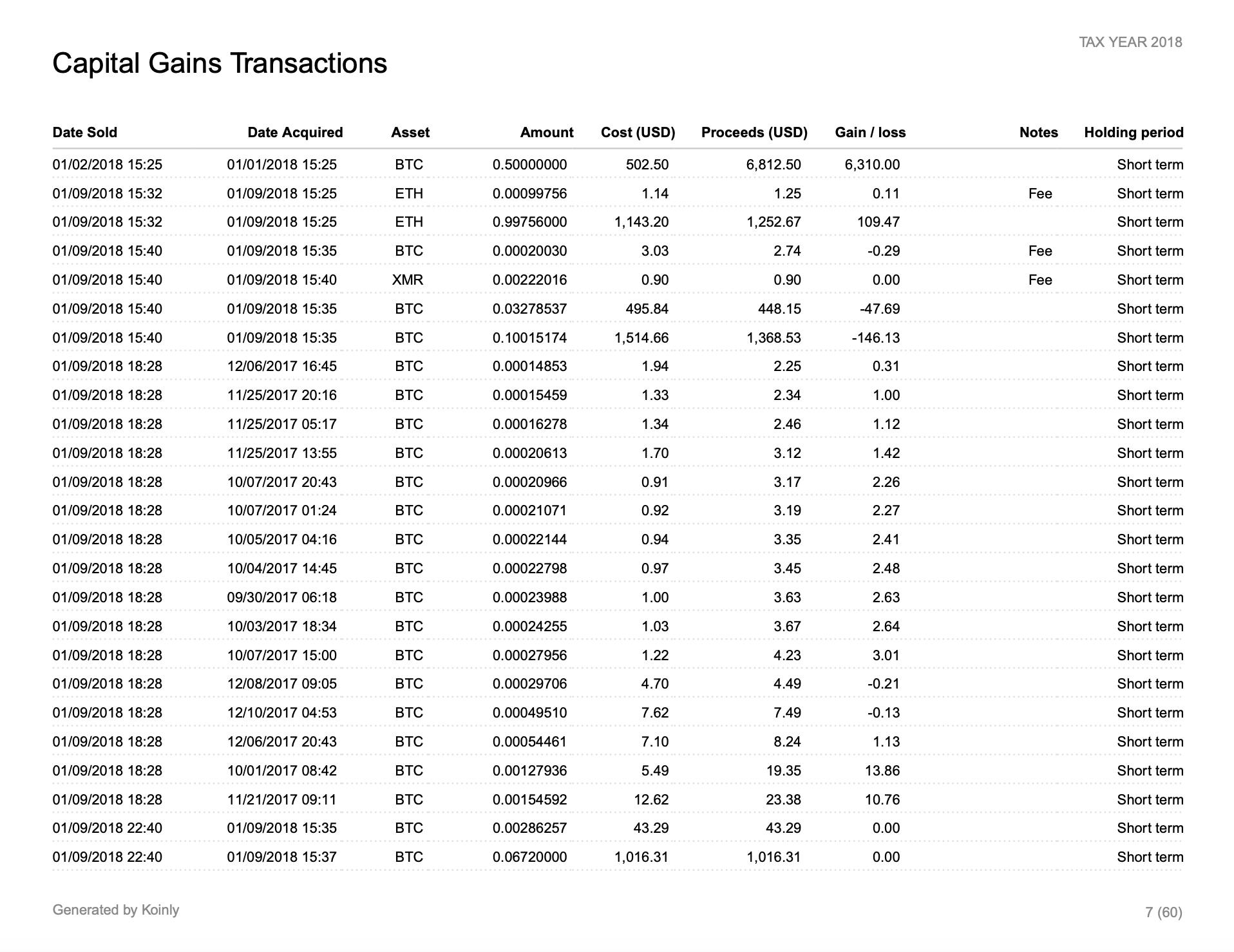

Get Started For Free. Income report - Mining staking etc. Capital gains report Download your capital gains report which shows your short and long term gains separately.

Crypto Tax Calculator Features. Check out our free guide on crypto taxes in New Zealand. Yes CryptoTaxCalculator is designed to generate accountant friendly tax reports.

All plans have a 30-day money-back guarantee. PoS awards validation rights on a lottery like basis. Our step by step wizard and cryptocurrency tax calculator is fine tuned for New Zealand and will help you figure out your crypto tax position to declare.

The tax rate on this particular bracket is 325. Use our Crypto Tax Calculator. File your crypto taxes in New Zealand.

Check out this table to know how to calculate your taxes. Buying crypto is not a taxable event see example 2 below. Cryptoassets and tax residence.

This new rate applies from 1st April 2021 according to the Inland Revenue. For example Ethereum says users will need to stake 32 ETH to become a validator. We have a list of certified tax accountants in New Zealand that specialize in cryptocurrencies.

Covers NFTs DeFi DEX trading. Evans Doyle 2 Kirkwood Street Cambridge 3450 020 4122 4440 timevansdoyleconz. After the end of the tax year 31 March you need to file an IR 3.

Taxoshi NZs Crypto Tax Caluclator. Coinpanda lets New Zealanders calculate their capital gains with ease. Citizens from New Zealand have to report their capital gains from cryptocurrencies.

You can discuss tax scenarios with your accountant. Janes estimated capital gains tax on her crypto asset sale is 1625. With the end of tax year coming up on the 7th of July next month Taxoshis automated.

Integrates major exchanges wallets and chains. To be in the draw a validator has to put up or stake its own cryptocurrency. Current proceeds are 13000.

Sold LTC worth 12000 for 13000 after more than a year. Contact us to ensure you are prepared for tax and have the right strategy in place. This means you can get your books up to date yourself allowing you to save significant time and reduce the bill charged by your accountant.

If you are an accountant you can also work with the Crypto Tax Calculator for 499year. Some cryptoasset transactions may not have an NZD value such as. Capital gains tax report.

Koinly helps New Zealanders calculate their income from crypto trading Mining Staking Airdrops Forks etc. Exchanging your cryptoassets for different cryptoassets. If youre converting between crypto and non NZD currencies you cannot use the apps NZD converter as it probably wont be the same as conversion rates released by the IRD for the tax conversion purposes.

Koinly can generate the right crypto tax reports for you. Using crypto to purchase goods or services is a taxable event. Proceeds - Cost Basis 1000 Profit.

For each dollar of income. Youll need to work out the NZD value of the cryptoassets. 0325 5000 1625.

From 14001 up to 48000. The tax treatment of crypto assets first became a hot issue in 2016 when the price of bitcoin rose from US500 to US1200 and continued to climb strongly to almost US20000 by the end of 2017. Selling crypto for fiat eg NZD is a taxable event examples below Trading one coin for another is a taxable event.

Taxoshi is a cryptocurrency tax calculator focused on helping kiwis understand their tax position. A If you are a tax resident.

Declaring Crypto Taxes In New Zealand Inland Revenue Koinly

Cryptotaxcalculator Io Review 2022 Is Cryptotaxcalculator Legit Safe

Capital Gains Tax Calculator Ey Us

I Built An Income Tax Calculator Using Formidable Forms For The Cook Islands Govcrate Blog

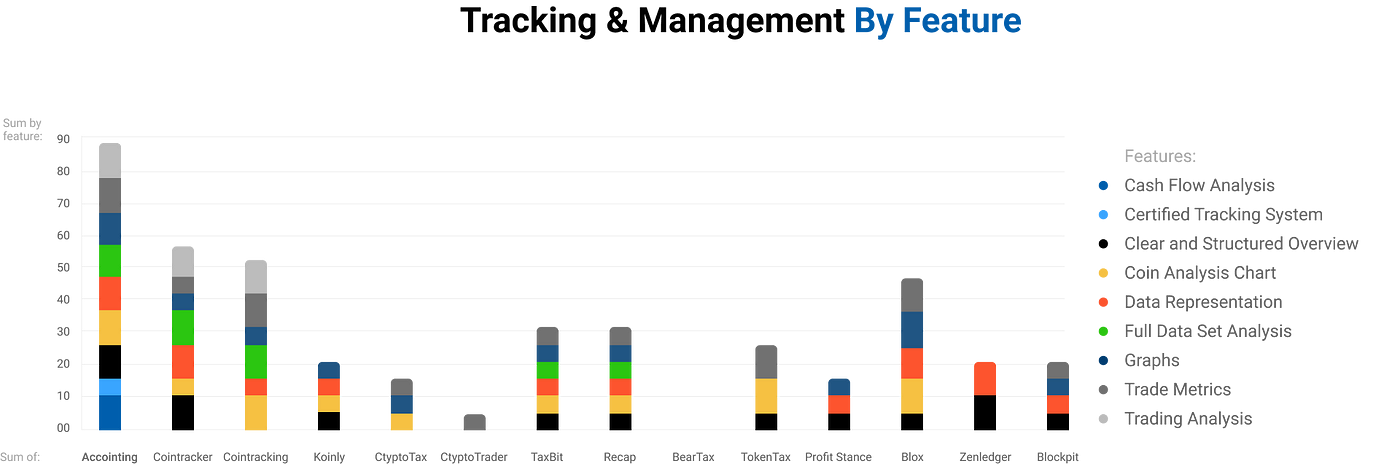

Best Crypto Tax Software Top 5 Bitcoin Tax Calculator 2022 Coinmonks

Best Crypto Tax Software Top 5 Bitcoin Tax Calculator 2022 Coinmonks

Cryptotaxcalculator Io Review 2022 Is Cryptotaxcalculator Legit Safe

Koinly Review Mar 2022 Cryptocurrency Tax Made Easy Yore Oyster

New Zealand Calculate And File Bitcoin Crypto Taxes Coinpanda

Best Crypto Tax Software Top 5 Bitcoin Tax Calculator 2022 Coinmonks

Cryptocurrency Tax Reports In Minutes Koinly

Product Cost Price Profit Calculator Ebay Etsy Mercari Etsy Google Sheets Pricing Calculator Excel Spreadsheets

Cryptocurrency Taxes What To Know For 2021 Money

Calculator And Euro Banknotes On A Table Free Image By Rawpixel Com Karolina Kaboompics Time Value Of Money Free Money Calculator

Best Crypto Tax Software Top 5 Bitcoin Tax Calculator 2022 Coinmonks